The Cheapest Ways to Send Money in the Philippines

Looking to send money to the Philippines without breaking the bank? You’re in the right place. We’ll walk you through the cheapest options, from online providers like Remitly to newer methods like cryptocurrency.

We’ll also delve into factors affecting transfer costs and how your money can be received. So, whether you’re supporting family or paying for a business transaction, we’ve got you covered.

Let’s dive in and find the best way to stretch your pesos.

Table of Contents

Transfer Options Overview

When you’re looking to send money to the Philippines, it’s crucial to consider different transfer options. These options include international wire transfers through banks, money transfer services like Wise and Western Union, or even cryptocurrencies.

By exploring these options, you can find the most cost-effective method.

To start, compare the best money transfer services. Look for those that offer low fees and fast transfer times. This will help you secure the best exchange rate.

Next, review the international money transfer policies of your bank. They might offer competitive rates that could be worth considering.

Lastly, consider cryptocurrencies if the receiver is tech-savvy. This can be an alternative method for transferring money to the Philippines.

By analyzing all options and making an informed decision, you can effectively transfer money to the Philippines.

Bank Transfers

You’ll find that bank transfers can be a cost-effective method for sending funds to the Philippines. When you wish to transfer money from the US to the Philippines, you might choose a bank transfer for its reliability and simplicity.

All you need are the recipient’s bank account details to initiate the transfer. While this method can be convenient, it’s crucial to consider transfer fees while sending money.

Different banks may charge varying fees, so it’s wise to compare your options to find the best money transfer solution.

Some banks may offer lower transfer fees or even waive them under certain conditions. So, when you’re seeking the cheapest way to send money to the Philippines, don’t overlook the humble bank transfer.

Money Transfer Services

Money transfer services are another popular option for sending funds to the Philippines. These companies specialize in international money transfers, making them one of the cheapest ways to send money from the USA and other countries.

When looking for the best way to send money abroad, consider the rates and fees of different money transfer providers. Some popular options include Wise, XendPay, and WorldRemit.

These money transfer services offer competitive exchange rates and low fees, which can make a big difference when sending large amounts.

It’s essential to compare different money transfer companies to find the best and cheapest way to send money to the Philippines.

Remember, the cheapest option may not always be the best, so consider other factors like speed and customer service.

Receiving Methods

If you’re receiving money in the Philippines, there are several methods available that can suit your needs and circumstances.

For instance, bank deposits are secure options for large amounts. However, keep in mind that a majority of Filipino adults are unbanked.

Another popular way to receive the money is through cash collections. This option is particularly helpful for those who lack access to formal banking services.

You can also opt for mobile deposit if you have access to mobile money or cash delivery if you’re in a location where this service is available. Remember, to pick up the money quickly, ensure your physical address is accurate.

If you’re sending money to another family member in the Philippines, these options make remittances to the Philippines quicker and easier.

Determining transfer costs

Determining the cost of your transfer is a crucial step in the process. When you’re looking for the cheapest way to send money, remember that the cost of sending money from the United States or anywhere else internationally to the Philippines depends on several factors.

These include the money transfer service you choose, the amount you’re sending, and the exchange rate. Keep in mind that different services charge different fees.

Thus, part of determining transfer costs involves comparing various services to get the best exchange rate possible.

Remember to factor in how you’ll pay for your money transfer, as some methods may incur additional costs. By understanding these factors, you’ll be able to make cost-effective transfers to the Philippines.

Cryptocurrency Considerations

When you’re considering sending funds to the Philippines, don’t overlook the potential of using cryptocurrencies. This could potentially be the best way to send money, given their low transaction costs.

Cryptocurrencies like Bitcoin can sometimes offer the cheapest option to send money from India, the US, or anywhere else in the world. When you send the money through a cryptocurrency exchange, you’re essentially sending online money, which can be cheaper and faster than traditional methods.

Be sure to compare the best options before making a decision. Keep in mind that the best provider for your international money transfer should offer a balance between cost, speed, and reliability.

So, explore all options for sending money to ensure you’re making the most financially sound decision.

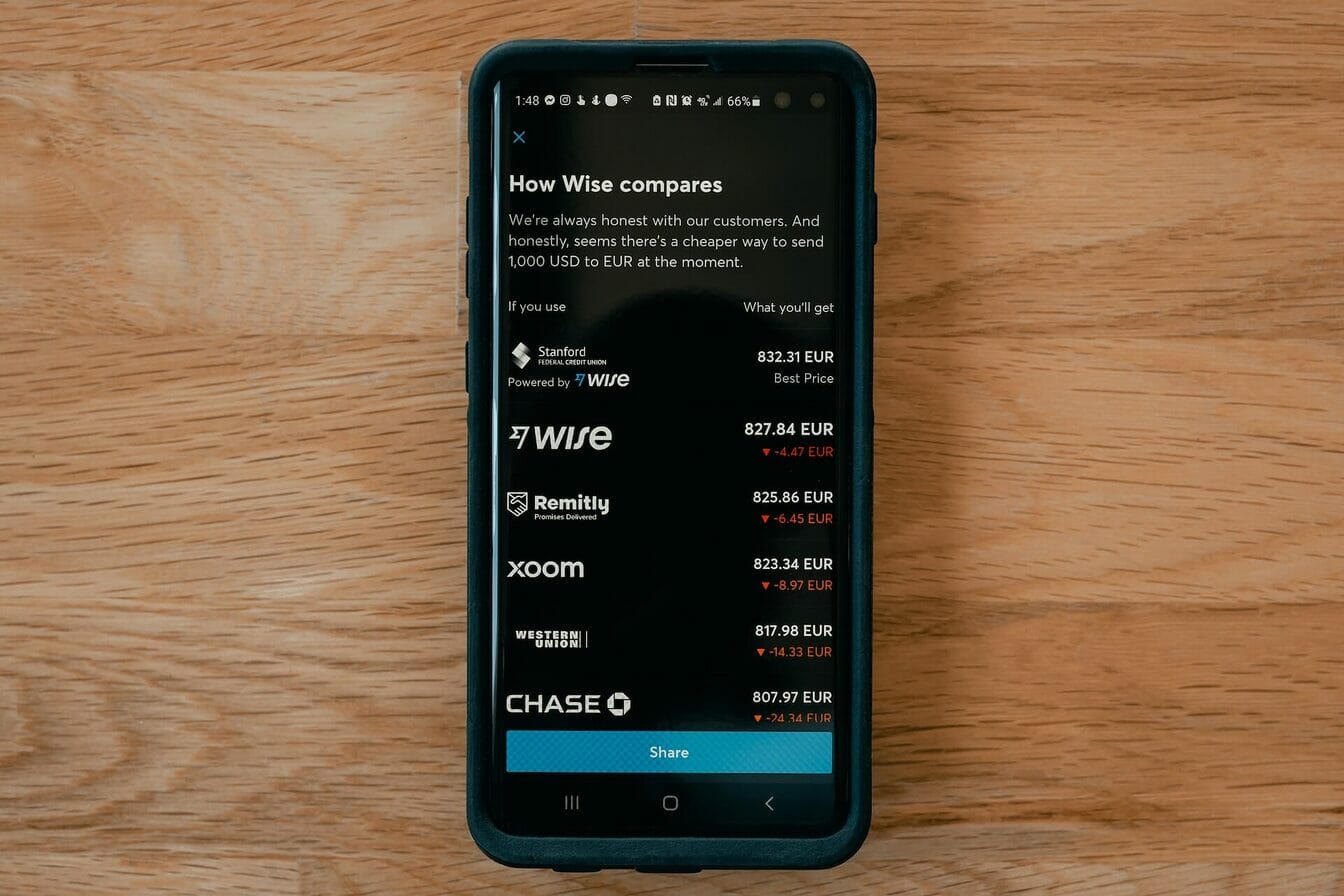

Provider Comparisons

You’ll find it beneficial to compare different providers before deciding to send money to the Philippines. The cheapest way might not always be the best fit for your needs.

Provider comparisons are essential to ensure you find the best provider for you. Keep in mind the total cost, transfer speed, and customer service quality.

Consider how you want to send money from the USA to the Philippines. There are various ways to transfer money, including bank transfers, money transfer services, and even cryptocurrency.

Some providers specialize in sending money abroad, offering competitive rates and fast transfer times. Always review your options carefully, as this can significantly impact how much money your recipient receives in the end.

Frequently Asked Questions

1. How can I send money to the Philippines?

There are various options available, such as using a money transfer service or money transfer companies. They offer the fastest way to send money internationally. You can also choose to transfer money directly to a bank account. Make sure to compare the transfer fee and find the best exchange rate to make it the cheapest for you.

2. Can I transfer money to the Philippines from the USA?

Absolutely! You can easily transfer money from the United States to the Philippines. Look for providers that offer transfers to the Philippines or specifically cater to sending money between the USA and the Philippines. Consider factors like transfer fees, exchange rates, and transfer speed to find the most suitable option.

3. How can I receive money in the Philippines?

To receive money in the Philippines, provide your sender with your bank account details or any other specified method of receiving funds. Once the sender completes the transfer, you will be able to get your money according to the chosen transfer method.

4. How do I find the cheapest way to send money?

To find the cheapest way to send money, compare different providers and look for the best exchange rates and low transfer fees. Consider factors such as the transfer speed, security, and previous issues or complaints.